placer county california sales tax rate

Retailers typically pass this tax along to buyers. While the State of California only charges a 6 sales tax theres also a state mandated 125 local rate bringing the minimum sales tax rate in the state up to 725.

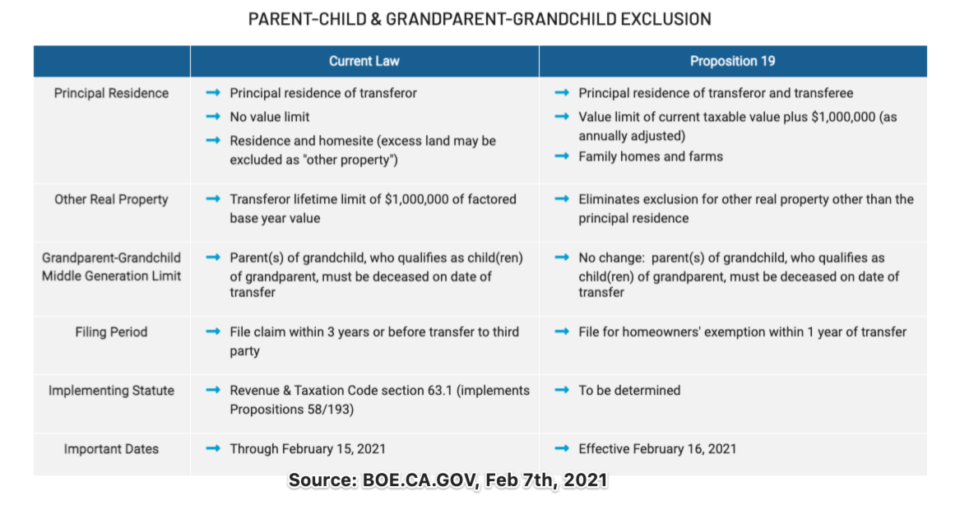

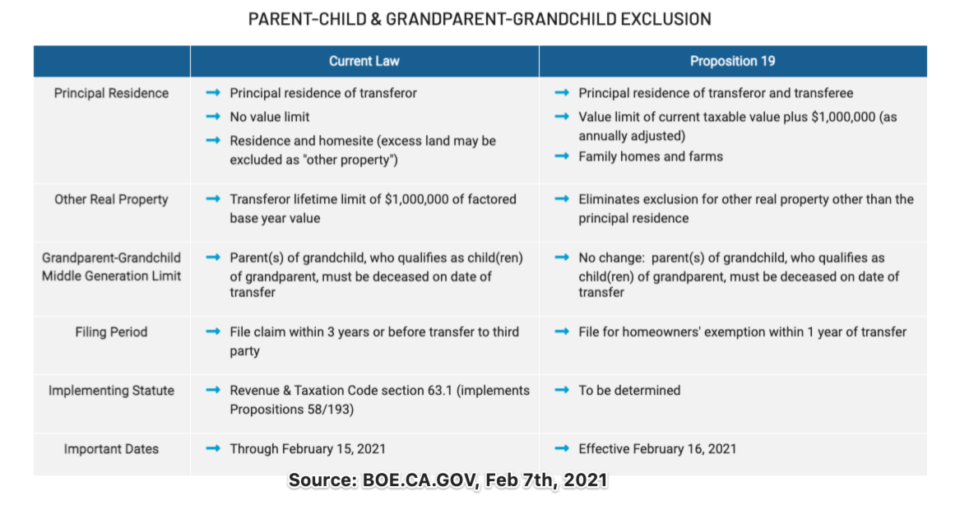

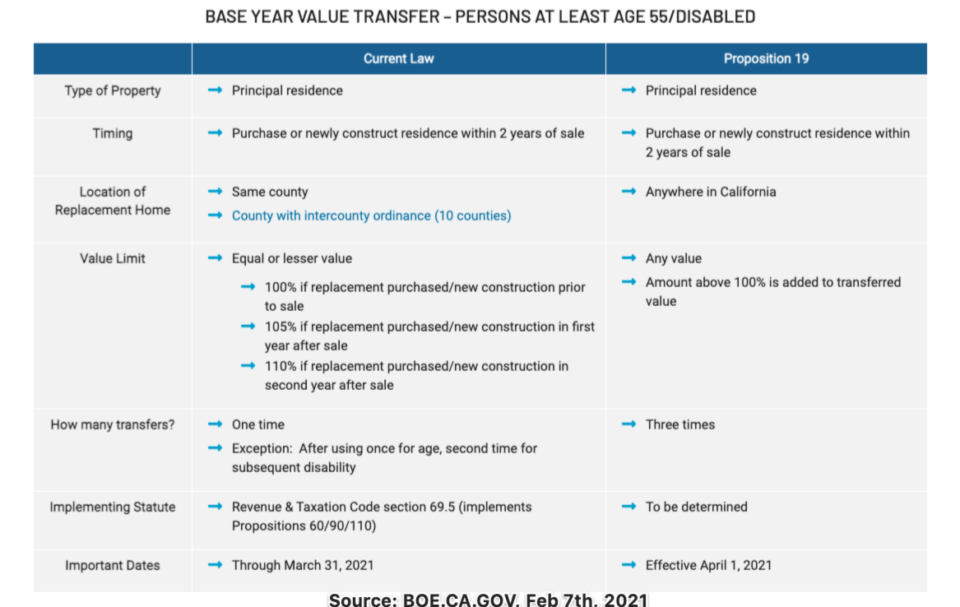

Prop 19 And Property Taxes In California Marc Lyman

The base sales tax rate of 725 consists of several components.

. The statewide tax rate is 725. Local tax rates in California range from 015 to 3 making the sales tax range in California 725 to 1025. Minus Tax Amount 000.

In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. Check out information and services such as online payments finding your tax rate and setting up auto payments. The Placer County sales tax rate is 025.

This is the total of state county and city sales tax rates. Placer County California Sales Tax Rate The Placer County California sales tax is 725 the same as the California state sales taxWhile many other states allow counties and other. The sales tax rate for Placer County was updated for the 2020 tax year this is the current sales tax rate we are using in the Placer County California Sales Tax Comparison Calculator for 202122.

How much is sales tax in Placer County in California. Retailers are taxed for the opportunity to sell tangible items in California. California sales tax rates vary depending on which county and city youre in.

Orange County CA Sales Tax Rate. Tax Rate Areas Placer County 2022. Sales tax in Placer County California is currently 725.

The California state sales tax rate is currently 6. The County sales tax rate is. Sales Tax in Roseville CA.

The 2018 United States Supreme Court decision in South Dakota v. Those district tax rates range from 010 to 100. The minimum combined 2022 sales tax rate for Placerville California is.

Placer County CA Sales Tax Rate. The Placerville sales tax rate is. A county-wide sales tax rate of 025 is.

Of the 725 125 goes to the county government. Zillow has 958 homes for sale in Nevada County CA. Each TRA is assigned a six-digit numeric identifier referred to as a TRA number.

Clerk of the Board-Property Tax Assessment Appeals. Exceptions include services most groceries and medicine. 26 rows The Placer County Sales Tax is 025.

Lowest sales tax NA Highest sales tax 1075 California Sales Tax. A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the regular city or county assessment roll per Government Code 54900. To review the rules in California visit our state-by-state guide.

Whether you are already a resident or just considering moving to Placer County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Has impacted many state nexus laws and sales tax collection requirements. The sales tax also includes a 50 emissions testing fee.

Sacramento County CA Sales Tax Rate. The main increment is the state-imposed basic sales tax rate. Sales tax in California varies by location but the statewide vehicle tax is 725.

The California sales tax rate is currently. Find your California combined state and local tax rate. 6 rows The Placer County California sales tax is 725 the same as the California state.

San Benito County CA Sales Tax Rate. Some areas may have more than one district tax in effect. Learn all about Placer County real estate tax.

The sales tax is assessed as a percentage of the price. Riverside County CA Sales Tax Rate. What is the sales tax rate in Placerville California.

Average Sales Tax With Local. View listing photos review sales history and use our detailed real estate filters to find the perfect place. San Diego County CA Sales Tax.

As you would imagine with a combined citycounty sales tax rate of 125 Roseville comes in on the low end for sales taxes in California. Placer County in California has a tax rate of 725 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Placer County totaling -025. The mandatory local rate is 125 which makes the total minimum combined sales tax rate 725.

Did South Dakota v. California has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 35. Plumas County CA Sales Tax Rate.

3 rows Placer County CA Sales Tax Rate The current total local sales tax rate in Placer County. Enter an amount into the. The local government cities and districts collect up to 25.

Plus Tax Amount 000. San Bernardino County CA Sales Tax Rate.

Joshua Fonseca Chief Executive Officer Elevation 6 250 Linkedin

100 Fastest Growing Cities In California 2022 Pro Mover Reviews

Access Denied Digital Cable Tv Internet Phone Xfinity

Prop 19 And Property Taxes In California Marc Lyman

Prop 19 And Property Taxes In California Marc Lyman

Prop 19 And Property Taxes In California Marc Lyman

Family Income And Poverty Summary Kidsdata Org

How Tax Collections From Online Sales Rose Ucla Anderson Review

Santa Clara County Ca Property Tax Search And Records Propertyshark

The Economics Of The Lottery Smartasset

Australia Gold Nugget Beautiful Flat Nugget 0 00 Gold Nuggets For Sale Buy Gold Nuggets Australian G Natural Gold Nugget Gold Nugget Beautiful Flats

How Tax Collections From Online Sales Rose Ucla Anderson Review

How Tax Collections From Online Sales Rose Ucla Anderson Review

How Tax Collections From Online Sales Rose Ucla Anderson Review